The Pennsylvania Department of Labor and Industry increased the maximum an injured worker can receive in weekly workers’ compensation benefits to $1,325 for work injuries occurring on and after January 1, 2024. This represents a 4 percent increase from 2023.

An injured worker’s weekly compensation rate depends on the injured worker’s salary. The maximum in 2024 is $1,325, but not everyone will receive that amount. Under the Pennsylvania Workers’ Compensation Act, the general rule is that an injured worker’s weekly workers’ comp. benefits will be 2/3, or 66.6%, of their “average weekly wage.” However, the percentage can be as high as 90% for an injured worker who is on the lower end of the wage scale. For example, a person that earns $650 per week in wages will receive weekly workers’ comp. benefits of $585. For a person who earns in the vicinity of $900 a week, the percentage will decrease to the 75% range.

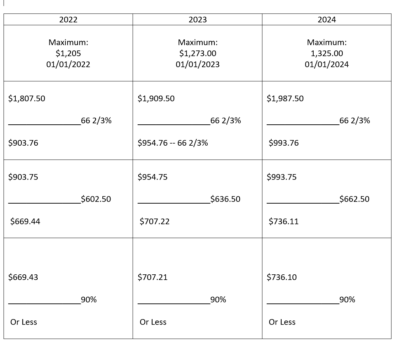

The chart below shows that the maximum weekly compensation rate for 2024 is $1,325.00. Injured workers whose average weekly wage falls between $1,987.50 and $993.76 will receive a workers’ comp rate of 66 2/3 percent of their wages.

The third block reflects a weekly compensation rate of $662.50. If the employee’s average weekly wage is between $993.75 and .$736.11, the weekly compensation rate is $662.50.

Employees earning $736.10 or less will receive 90% of their average weekly wage.

Unfortunately, if you make more than $1,987.50 a week, your weekly workers’ comp benefits will be capped at $1,325.00.

We have emphasized that the average weekly wage dictates how much a person will receive in weekly workers’ comp. benefits. But how exactly is that calculated? It is based on a worker’s gross wages (before taxes), not their net wages (after taxes). The calculation is based on wages for the year preceding the injury. If someone is injured on January 10, 2024, then their wages would be considered from January 10, 2023 until January 9, 2024. Their wages are computed for each of the four quarters during this one-year period, and the average of the worker’s highest three quarters becomes their average weekly wage. This complicated formula is designed to ensure that the calculation of wages is an accurate and realistic measure of what the employee could have earned but for the injury.

Yes. Not everybody has worked for an employer for a year when they are injured. Some people have only been employed for nine months; others only three months; and some injured workers have only been on the job for a week. There have even been cases in which unlucky people have suffered injuries on their first day working for an employer. Regardless of the duration of their employment, all employees are entitled to workers’ comp. benefits if they injured themselves in the course of their employment. The rules for calculating the average weekly wage are different for those employed less than a year, especially for those who had been working less than 13 weeks for an employer when their injury occurred. Under that scenario, because the employee has not established much of a track record, the average weekly wage is based on their expected earnings – what their employer told them they can expect to earn at the job when they were hired.

If you work in the restaurant business, the majority of the money you earn is likely from cash tips. Suppose you work as a bartender at a restaurant and slip on a wet floor, sustaining injuries. Let’s say over the previous year, your average weekly paycheck was $200, but you made another $700 per week in tips.

The Pennsylvania Workers’ Compensation Act provides that the additional money you earned in tips can be included as part of the average weekly wage calculation as long as you report those tips on your federal income taxes. In that case, your average weekly wage would be $900, which would translate to a weekly workers’ comp. rate of $600.

How about bonuses? If you received a holiday bonus in December 2023 of $5,000 and injure yourself in 2024, for purposes of calculating your average weekly wage, that amount is pro-rated over the entire year — $1,250 for each of the four quarters. The rationale is that while this is a one-time bonus, your employer is paying this to reward you for your hard work throughout the year. Let’s say you injured yourself on December 10, 2023 and you received this $5,000 bonus on December 20, 2023, after your injury. While the general rule is that only monies earned before the date of injury can be considered, because the bonus is paid for your work throughout the year, it can be factored into your average weekly wage calculation, which will increase the amount of your workers’ comp. benefits.

If you have been injured at work or sustain injuries on the job, your rights – both with regard to your workers’ comp. rate and all other aspects of your claim – need to be protected. At Pearson Koutcher Law, we practice only workers’ compensation law – it is our specialty. Each of our PA workers’ comp lawyers has more than 25 years of experience handling workers’ comp. cases and knows all the ins and outs of our complex workers’ comp. laws. Please call us for a free, comprehensive consultation and see if we can help you.